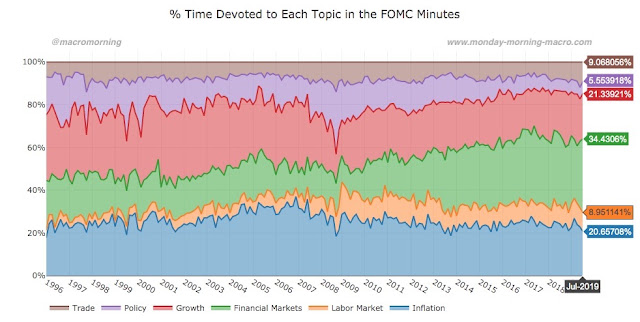

The Federal Reserve now spends over 1/3 of its time talking about financial markets in the minutes. That’s more than trade, monetary policy & employment combined.

This unhealthy obsession has become a distraction – and it’s leading financial markets down a dangerous path.

Ironically, this is happening at the same time that the Fed’s obsession with market sensitivity is also the highest – and when their companion central bankers globally are considering unveiling new measures for further competitive currency devaluation monetary easing. At some point, the bazooka won’t be able to reload fast enough.

REFERENCES:

Blei, D. M., Ng, A. Y., & Jordan, M. I. (2003). “Latent Dirichlet Allocation.” Journal of Machine Learning Research, 3, 993-1022.

Jegadeesh, N., & Wu, D. (2015). “Deciphering Fedspeak: The Information Content of FOMC Meetings.” working paper, Emory University.

Blei, D. M., (2012). “Probabilistic Topic Models.” Communications of the ACM, 55(4), 77-84

Hansen, S., McMahon, M., & Prat, A. (2014). “Transparency and Deliberation Within the FOMC: a Computational Linguistics Approach.”

Prices from the CME group, Bloomberg.

Disclosure/Disclaimers: This material may contain indicative terms only, including but not limited to pricing levels. There is no representation that any transaction can or could have been effected at such terms or prices. Proposed terms and conditions are for discussion purposes only. Finalized terms and conditions are subject to further discussion and negotiation. OTC Derivatives Risk Disclosures: To understand clearly the terms and conditions of any OTC derivative transaction you may enter into, you should carefully review the terms of trade with your counterparty, including any related schedules, credit support documents, addenda and exhibits.

You should not enter into OTC derivative transactions unless you understand the terms of the transaction you are entering into as well as the nature and extent of your risk exposure. You should also be satisfied that the OTC derivative transaction is appropriate for you in light of your circumstances and financial condition. In addition, you may be requested to post margin or collateral to support written OTC derivatives at levels consistent with the internal policies of your respective counterparty. I may have positions in assets mentioned above, but do not have plans to initiate any new positions within the next 72 hours.

This post was written by me, the material is my own (except where sourced), and it expresses my own opinions. I am not receiving compensation for it & have no business relationship with any of the companies and/or organizations whose assets may be mentioned in this post.

This unhealthy obsession has become a distraction – and it’s leading financial markets down a dangerous path.

Chart shows the proportion of FOMC meeting minutes that cover specific topics – based on an LDA analysis similar to that described by Blei et al (2003) & Jegadeesh & Wu (2015). Table reports avg proportion by topic for select years.

Expectations have done something funny over the past week as the market digests Wednesday’s minutes ahead of Powell’s speech at Jackson Hole. It’s going to have to be a very delicate performance for a Fed Chair whose recent linguistic gymnastics have been anything but. Complacency still remains remarkably high in the riskiest assets, while skew in bonds & gold tell a very different story.

Now, let’s look at what expectations have done across markets over the past week – for example. Here’s what the moves have been across normalized skew for:

1. 1wk expiries (end of the month). Y-axis = change in vols, X-axis = delta (25DP = 25-delta put).

2. 4mth expiries (end of the year). Y-axis = change in vols, X-axis = delta (25DP = 25-delta put).

Now, it’s pretty clear which direction we’re moving in – and it’s all thanks to the fact we’ve seen a pretty hefty rally over the past week in risk assets as we prepare for the largest annual convocation of central bankers.

But what’s important before we get too carried away is that skew in general is already quite positioned the other way (obviously puts over calls in SPX, HY etc & vice versa in Gold & USTs).

Here’s a snapshot of the shape of the surface in delta terms.

3. 1wk expiries (end of the month). Y-axis = OTM – ATM vol, X-axis = delta (25DP = 25-delta put).

But what’s important before we get too carried away is that skew in general is already quite positioned the other way (obviously puts over calls in SPX, HY etc & vice versa in Gold & USTs).

Here’s a snapshot of the shape of the surface in delta terms.

3. 1wk expiries (end of the month). Y-axis = OTM – ATM vol, X-axis = delta (25DP = 25-delta put).

4. 4mth expiries (end of the year). Y-axis = OTM – ATM vol, X-axis = delta (25DP = 25-delta put).

Before we look at these profiles & dismiss them with “well, that’s just because put skew is always elevated in risk assets…”, think about this for a moment. Here’s where we are in historical terms. Below shows 1yr expiry 25-delta risk reversals (calls over puts), 5yr z-score.

First, here’s what the cost of calls on Gold & 30yr USTs looks like. We are right about at the 5-year highs on this chart. Clearly, the market is starved for upside on both assets whether because of duration needs, QE, or flight to quality (or some mix of all three).

5. 5yr history: Gold & 30yr calls – puts, 1yr expiry z-score.

First, here’s what the cost of calls on Gold & 30yr USTs looks like. We are right about at the 5-year highs on this chart. Clearly, the market is starved for upside on both assets whether because of duration needs, QE, or flight to quality (or some mix of all three).

5. 5yr history: Gold & 30yr calls – puts, 1yr expiry z-score.

Now, compare that to what we see in “risk assets”.

Here is what the z-score of calls – puts looks like for SPX & HY. Despite the fact we’re within spitting distance of the all-world highs, the cost of protection is about middle of the range relative to the historical mean.

6. 5yr history: SPX & HY calls – puts, 1yr expiry z-score.

Here is what the z-score of calls – puts looks like for SPX & HY. Despite the fact we’re within spitting distance of the all-world highs, the cost of protection is about middle of the range relative to the historical mean.

6. 5yr history: SPX & HY calls – puts, 1yr expiry z-score.

It’s disconcerting to see such an imbalance – especially when the degree to which complacency appears evident in “risk assets”. Unless Powell is capable of brandishing some new form of easing we’re hitherto unaware exists, this would suggest to me there’s a rude awakening that’s set to brew in the very assets whose sensitivity to a disappointment is highest.

Now, a 50bp cut in September would be exactly the sort of thing that might satisfy BOTH sides of the equation: “well, I don’t need that much downside protection in equities or high yield because of could the Fed is going to bail me out with a larger cut than necessary, in order to hedge against downside in the economy, a lack of inflation, or the ever-present threat of bubonic plague just in time for the holiday shopping season.”

But that’s NOT what’s priced. If anything, the rates pendulum has swung further back to ambivalence. And we’re now pricing a more likely than not outcome of only 25bps via the Eurodollar options market (though, to be fair, there’s still a wobble around where the tail between a -25 and -50 cut would land as seen in the squiggle made by the red line around 1.50% below…).

Now, a 50bp cut in September would be exactly the sort of thing that might satisfy BOTH sides of the equation: “well, I don’t need that much downside protection in equities or high yield because of could the Fed is going to bail me out with a larger cut than necessary, in order to hedge against downside in the economy, a lack of inflation, or the ever-present threat of bubonic plague just in time for the holiday shopping season.”

But that’s NOT what’s priced. If anything, the rates pendulum has swung further back to ambivalence. And we’re now pricing a more likely than not outcome of only 25bps via the Eurodollar options market (though, to be fair, there’s still a wobble around where the tail between a -25 and -50 cut would land as seen in the squiggle made by the red line around 1.50% below…).

Ironically, this is happening at the same time that the Fed’s obsession with market sensitivity is also the highest – and when their companion central bankers globally are considering unveiling new measures for further competitive currency devaluation monetary easing. At some point, the bazooka won’t be able to reload fast enough.

REFERENCES:

Blei, D. M., Ng, A. Y., & Jordan, M. I. (2003). “Latent Dirichlet Allocation.” Journal of Machine Learning Research, 3, 993-1022.

Jegadeesh, N., & Wu, D. (2015). “Deciphering Fedspeak: The Information Content of FOMC Meetings.” working paper, Emory University.

Blei, D. M., (2012). “Probabilistic Topic Models.” Communications of the ACM, 55(4), 77-84

Hansen, S., McMahon, M., & Prat, A. (2014). “Transparency and Deliberation Within the FOMC: a Computational Linguistics Approach.”

Prices from the CME group, Bloomberg.

Disclosure/Disclaimers: This material may contain indicative terms only, including but not limited to pricing levels. There is no representation that any transaction can or could have been effected at such terms or prices. Proposed terms and conditions are for discussion purposes only. Finalized terms and conditions are subject to further discussion and negotiation. OTC Derivatives Risk Disclosures: To understand clearly the terms and conditions of any OTC derivative transaction you may enter into, you should carefully review the terms of trade with your counterparty, including any related schedules, credit support documents, addenda and exhibits.

You should not enter into OTC derivative transactions unless you understand the terms of the transaction you are entering into as well as the nature and extent of your risk exposure. You should also be satisfied that the OTC derivative transaction is appropriate for you in light of your circumstances and financial condition. In addition, you may be requested to post margin or collateral to support written OTC derivatives at levels consistent with the internal policies of your respective counterparty. I may have positions in assets mentioned above, but do not have plans to initiate any new positions within the next 72 hours.

This post was written by me, the material is my own (except where sourced), and it expresses my own opinions. I am not receiving compensation for it & have no business relationship with any of the companies and/or organizations whose assets may be mentioned in this post.